UAE think tank report on Beijing Declaration, takeaways from Li's trip to the Gulf, Egyptian PM statement post-FOCAC, China's Ministry of Commerce warns of risk in auto factories abroad

Challenges Facing China’s Mediation between Palestinian Factions - Emirates Policy Center. The EPC is the most influential think tank in the UAE, and its publications are a good weather vane if you’re looking to get a sense of policy directions here. So it's interesting to see that their take is consistent with most assessments: China’s involvement in Palestinian politics “is primarily a symbolic diplomatic victory for China and does not offer any real, immediate value in resolving Palestinian divisions.”

Here are the key takeaways, but I’d encourage you to read the whole report.

China’s mediation has succeeded in pushing Palestinian factions to sign the Beijing Declaration to end divisions and enhance national unity. However, there is broad consensus that implementing this agreement will be challenging due to deep-rooted disagreements between Fatah and Hamas. Moreover, the ongoing war in Gaza and opposition from Israel and the US further complicate reconciliation efforts.

The Chinese mediation represents a symbolic diplomatic victory for Beijing. China’s involvement is closely tied to its broader strategy within the great power competition, as it seeks to boost is image as a responsible rising power committed to peace in the Middle East. Furthermore, Beijing aims to position itself as a key player in the peace process by offering an alternative vision to US policies, which China accuses of supporting Palestinian division and showing bias to Israel.

The optimal scenario for Beijing would be to displace the US from its historical position as a peace broker between Palestinians and Israelis. China favors a UN-led multilateral international peace conference where it could stand on equal footing with the US in terms of status and impact.

China is likely to intensify its efforts with Palestinian factions to advance reconciliation and implement the Beijing Declaration. Beijing will also continue its diplomatic outreach to secure support from influential Arab capitals, especially those that are reluctant to see Hamas play a pivotal role in the Palestinian government or in post-war arrangement for Gaza.

China ready to work closely with Saudi Arabia, advancing together on path of development: Premier Li - Xinhua. An interesting bit from Saudi Minister of Investment Khalid Al-Falih:

"We now have about 750 Chinese joint ventures or companies operating in the Kingdom alone, so the Chinese presence is increasing. Today, many unprecedented construction projects in Saudi Arabia are supplied by Chinese contracting companies and building materials companies, including significant projects in NEOM, tourism projects, etc. We aspire to increase Chinese investments in the Kingdom, especially in the new promising areas of the Saudi economy," said Al-Falih.

750 is pretty low; in the UAE the number we frequently hear is over 6000 Chinese firms operating here. Of course, many of these are based in Dubai and servicing contracts across the region. I’ve often wondered if Chinese companies were a focal point in Saudi’s proclamation that any company that wants a government contract would need to relocate its regional HQ to the Kingdom. If so, it hasn’t had much of an impact yet.

Also interesting, given the implementation of Chinese language classes in the Saudi public school system, is talk of greater cultural / educational cooperation:

The key to state-to-state relations lies in close bonds between peoples. During his visit, Li also urged both sides to successfully organize the China-Saudi Arabia Year of Culture in 2025, advance cooperation in culture, think tanks, education, media, non-governmental and people-to-people exchanges, and continuously enhance mutual understanding and friendship between the peoples of the two countries.

In recent years, people-to-people exchanges between the two countries have continued to grow. Four Saudi universities have introduced Chinese language majors, and eight primary and middle schools now offer optional Chinese language courses for their students.

China, Saudi Arabia fortify pillar of relations by expanding investment, trade - State Council, PRC. A short read-out on Li Qiang’s time in Saudi. In another trend that I’ve seen a lot of in the Gulf over the past year plus, he tried to drum up investment from Saudi into China.

Throughout these engagements, the key focus was consistently on deepening trade and investment ties.

In discussions with Saudi business representatives, Li urged Saudi companies to increase their involvement in the Chinese market, assuring them that China is committed to building a top-tier business environment that is market-driven, law-based and internationally oriented.

I’ve just been reading last week’s issues of The Economist, and presume folks at PIF have seen the same article about inaccurate economic data coming from China.

But the realm of what is considered too sensitive has expanded rapidly in recent years, and now includes much discussion about the economy. Academics and pundits who seek to debate seemingly mundane economic matters are silenced. Data that used to be readily available are disappearing from the public sphere. That not only further restricts ordinary people’s already limited freedom to speak their minds, but also harms growth by hampering investment. Most of all, it underscores Mr Zhao’s pressing question: on what basis is economic policy made? What does the government know that ordinary people do not—and how reliable is the information on which it is basing its decisions?

What we don’t know about the Chinese economy is a weird X factor that I’m sure investors try to add into their assessments; I assume it makes for an uncomfortable level of risk. Another article in the same issue addressed China’s massive slump in FDI:

Foreign direct investment (FDI) in the country slumped to minus $14.8bn in the second quarter of this year, the worst figure on record. Any dollars ploughed in were comfortably outweighed by foreign investors selling stakes, collecting loan repayments or repatriating earnings. A separate figure that is calculated by the Ministry of Commerce dropped by almost 30% in yuan terms in the first seven months of this year, compared with the same period last year. Only during the global financial crisis of 2007-09 has FDI fallen as steeply.

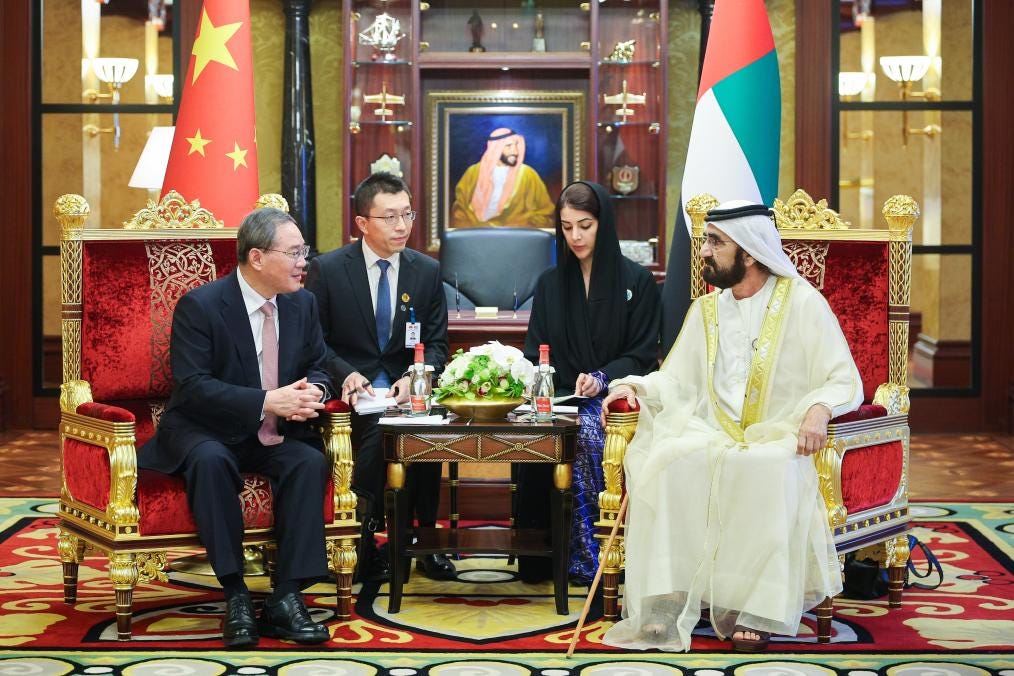

Li calls for high-quality BRI bond with UAE - China Daily. Premier Li Qiang spoke at the UAE-China Business Forum in Dubai last Thursday, which was attended by more than 200 representatives from the governments, chambers of commerce and businesses from the Emirates and China. He went through a predictable list of cooperation priorities:

The premier called on enterprises from the two countries to seize new opportunities for high-quality Belt and Road cooperation, and enhance cooperation in areas such as connectivity, infrastructure and financing to promote their deeper integration into global industrial and supply chains.

Li also urged the enterprises to identify more areas of shared interest and opportunity for cooperation from the intersection of their strategic priorities, and deepen cooperation in trade, new energy, tourism and other sectors.

Cooperation in cutting-edge fields such as advanced manufacturing, the digital economy and artificial intelligence should also be emphasized to jointly seize future development opportunities, he added.

As in Saudi, Li made a pitch for Emirati investment into China:

China welcomes more enterprises from the UAE to invest in the country, Li said, adding that he believes that with the joint efforts of entrepreneurs from both sides, bilateral trade cooperation will continue to thrive.

Egyptian PM hails "positive results" of China visit - Xinhua. Statement from Egyptian Prime Minister Mostafa Madbouly upon his return home from FOCAC:

"This visit yielded positive results, thanks to the signing of contracts for several projects within the Suez Canal Economic Zone (SCZone), as well as memoranda of understanding to enhance cooperation in communications and information technology between Egypt and China."

I’ll be looking onto the communications and IT MoUs. These are areas where China doesn’t really need to compete in Egypt, it seems, since private companies seem reluctant to wade into an opaque economy. My understanding is that Chinese companies have made significant inroads in these sectors. If you’ve been reading this newsletter over the past few weeks you’ve noticed a lot of stories about China-Egypt. Not a coincidence. There’s a lot happening between the two, and I think it has significant consequences. I’m mapping out a larger essay on this.

China warns carmakers of risks in building plants overseas, sources say - Reuters. Interesting given all the recent stories about Chinese car companies setting up factories in Turkiye and Morocco.

China's commerce ministry has warned the country's carmakers of the risks of making auto-related investments overseas at a recent meeting, said two people briefed about the matter, as they seek global expansion to counter slowing growth in their home market.

At a meeting held in early July, the ministry told local carmakers not to invest in India, citing a directive from the central government, "strongly advised" against investing in Russia and Turkey, and used a more gentle tone to highlight risks in building factories in Europe and Thailand, one of the people said.

It also encouraged carmakers to use overseas factories for final vehicle assembly with knock-down components exported from China to mitigate potential risks stemming from geopolitical issues, said the person.

But no advice was given to them to make sure core electric vehicle technologies stay in the country, as first reported by Bloomberg News on Thursday, the two people said.

They declined to be named as they are not authorized to speak to the media.